The IRS issued a new revenue procedure regarding health savings account (HSA) limits. The new tax laws had a provision in it which was not formally enacted until just recently. The new revenue procedure now puts the change into effect. Basically the ruling reduces the HSA family maximum contribution for 2018 from $6,900 to $6,850 retroactive to January 1, 2018. Employers with HSAs will need to check to see if employees elected the $6,900 maximum for 2018, and in effect cut that back to $6,850. The new $6,850 max is a combination of any employee and employer contributions into the employee’s HSA for 2018. You can read more about the change below. Questons can be directed to Matt Pfeiffenberger, Vice President, …

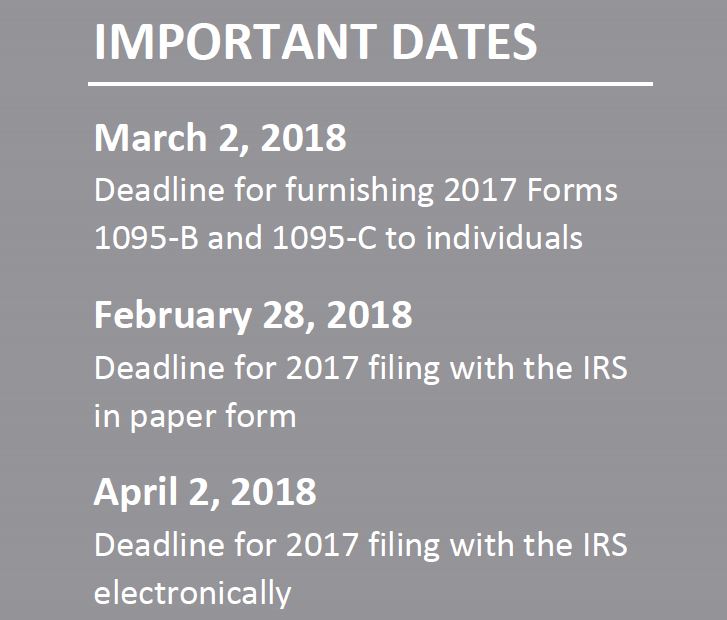

ACA Compliance – Furnishing Deadline Delayed for 2017 ACA Reporting

On December 22, 2017, the Internal Revenue Service (IRS) issued Notice 2018-06 to: Extend the due date for furnishing forms under Sections 6055 and 6056 for 2017 for 30 days, from January 31, 2018, to March 2, 2018; and Extend good-faith transition relief from penalties related to 2017 information reporting under Sections 6055 and 6056. Notice 2018-06 does not extend the due date for filing forms with the IRS for 2017. The due date for filing with the IRS under Sections 6055 and 6056 remains February 28, 2018 (April 2, 2018, if filing electronically). Section 6055 and 6056 Reporting Sections 6055 and 6056 were added to the Internal Revenue Code (Code) by the Affordable Care Act (ACA). Section 6055 applies …

Penn State Health, Highmark Join Forces

As reported on ABC 27 News, Penn State Health and Highmark Health have announced a new partnership. The $1-billion deal allows Penn State Health to expand and improve its locations across central Pennsylvania with the support of Highmark. “We really hope that through this new product, we’re going to make it that people throughout central Pennsylvania are still able to access this medical center and receive that sort of care closer to home,” Penn State Health CEO Dr. Craig Hillemeier said. Highmark customers are guaranteed access to the Penn State Health Network. Both companies say the deal aims to lower the cost of care for patients. Read the ABC 27 News article >>> If you have any questions, contact Matt Pfeiffenberger, VP, …

IRS Issues Pay Or Play Enforcement Guidance

On Nov. 2, 2017, the Internal Revenue Service (IRS) updated its Questions and Answers (Q&As) on the employer shared responsibility rules under the Affordable Care Act (ACA) to include information on enforcement. Specifically, these Q&As include guidance on: How an employer will know that it owes an employer shared responsibility penalty; Appealing a penalty assessment; and Procedures for paying any penalties owed. The IRS also maintains a website on understanding Letter 226-J, as well as a sample letter, which will be used to inform employers of their potential penalty liability. Action Steps – No penalties have been assessed under the employer shared responsibility rules at this time. However, employers subject to these rules are still responsible for compliance. These Q&As indicate …

Senate Votes to Move on to ACA Repeal and Replace Debate

This summary is provided by the Health Benefits Solutions team at Murray. Source: Joel Kopperud, Vice-President, Government Affairs Council of Insurance Agents and Brokers (CIAB) On Tuesday afternoon, July 25, the Senate voted 51-50 to open debate on ACA repeal-and-replace legislation! Vice President Pence cast the tie-breaking vote with Senators Susan Collins (R-ME) and Lisa Murkowski (R-AK) opposing the measure. This is a procedural vote that allows the Senate to now vote on a series of amendments which will ultimately determine what the replacement legislation will look like. There will most likely be a vote on 3 amendments: Senator Rand Paul’s (R-KY) amendment to fully repeal the ACA Senator Ted Cruz’s (R-TX) amendment to allow for “skinny” insurance plans Senators …

Healthcare Reform and House Amended AHCA – Right Back Where We Started

You have no doubt seen many articles, news releases or media reports on the House passage on May 4th on the amended American Health Care Act or AHCA (H.R. 1628). The vote, 217 to 213, was on strict party lines with 20 Republicans joining 193 Democrats in voting against the measure. In Pennsylvania, 13 Republicans voted for the Act, including Congressmen Barletta, Marino, Smucker and Perry while Congressmen Dent, Costello, Fitzpatrick and Meehan were no votes. The split among Pennsylvania’s Republicans is indicative of the inner turmoil within the Republican Party when it comes to any attempt to repeal Obamacare. We would like to provide you with an in-depth summary of the newly amended AHCA but what’s the point? We …

As Opioid Epidemic Rages, Worksite Policies Overlook Prescribed Drugs

Opioid use in our communities, is an issue that is exploding at an exponential level. As opioid abuse becomes more prevalent, it’s presence in the workplace is an increasing concern for all employers. As stated below, most employers want to be part of the solution, meaning that they want to help employees return to work at the appropriate time in their recovery process. Having the appropriate policies in place is critical to the success of that effort. Please contact us if you would like assistance modifying your existing drug and alcohol policy, or creating a new policy to deal with these issues. Questions? Contact Matt Pfeiffenberger, Vice President, Health Benefits Solutions, or Matt Olphin, CPCU, CSP, ARM, Vice President, Risk Control …

Why HR Managers Should Review Their HIPAA Procedures

According to the website “ebn”, HIPAA audits are on the rise, and so are associated fines. In 2016, the U.S. Department of Health and Human Service’s Office of Civil Rights collected $23 million in fines, a 300% increase over 2014, the previous record year for fines. Tell me more >>> An increase in audits and associated fines serve as a good reminder for employers to revisit training often to ensure compliance. For more information, contact Matt Pfeiffenberger, Vice President, Health Benefits Solutions.

How Repealing the ACA Could Affect Employer-Sponsored Health Plans

Overview Since the Affordable Care Act (ACA) was enacted in 2010, employers and health insurance issuers have had to make numerous changes to employer-sponsored group health plans offered to employees. If the ACA is repealed, many plan terms may no longer be required. These changes may be beneficial for employers, but could be confusing or, in some cases, unwelcome for employees. The ultimate impact of repealing the ACA will depend on the specific details of the repeal, and any replacement, that is enacted. While steps have been made toward repeal, it is unclear what impact those steps may have or what an ACA replacement will look like. Action Steps The initial steps, including an executive order issued by President Donald …

Self-insurance helps small businesses clear hurdle [Video]

It seems there's a never ending to-do list for small business owners, and insurance is squarely up there with the rest of the responsibilities.

- Page 1 of 2

- 1

- 2