Teke Drummond, Executive Director Penn Medicine HealthWorks, provided an overview of how businesses can best be prepared for safe and responsible operations in the current COVID-19 environment. Highlights covered in the webinar include: Overview of Penn Medicine HealthWorks as a comprehensive service to employers. Update on the current state of COVID 19 on our community. Understanding the recommendation of Prevention, Exposure Management, and Quarantine / Return to Work measures needed to ensure safety. Review of regulatory standards. Service recommendations to address employee well-being amidst COVID 19 and a modified work design. Update on testing protocols and contact tracing services. Click for “Kicking COVID Together, and use password sCMpEFw5 To further discuss, contact your Murray Health Benefits Consultant at 717.397.9600.

Congress Passes Bill Amending Paycheck Protection Program

Since being established as part of the Coronavirus Aid, Relief and Economic Security Act (CARES Act) in March 2020, the Paycheck Protection Program (PPP) has been the subject of additional stimulus bills, legal guidance and interim final rules. In the latest development, Congress passed the Paycheck Protection Program Flexibility Act of 2020, which is a bill that provides borrowers with greater flexibility in spending PPP funds without compromising forgiveness eligibility. What is included in the bill? If you have questions, contact Matt Pfeiffenberger, Vice President, Health Benefits Solutions at 717.283.9680.

Health Insurance Options for You and Your Family

By Tony Montgomery, Assistant Vice President, Senior Plan Advisor In today’s uncertain times, you may be unexpectedly looking for health insurance for you and your family. Whether you are losing your current insurance due to loss of employment or having hours reduced to where you no longer qualify for insurance through your employer, or are making a job change or looking to retire, there are a few options for healthcare coverage for you and your family. The first option is through the government Marketplace or Obamacare. These plans are normally available only during the open enrollment period of November 1 – December 15. However, if you are losing your current insurance, you may be eligible for a Special Election Period …

Health Plans Must Provide Free COVID-19 Testing – Legal Update

The Families First Coronavirus Response Act (FFCRA) requires group health plans and health insurance issuers to cover COVID-19 testing without imposing any cost sharing. Key Points: Employer-sponsored group health plans must cover COVID-19 testing, without imposing a deductible, copayment or other cost sharing. This mandate applies to fully insured group health plans and self-insured group health plans. Plans and issuers must pay the provider-negotiated rate for testing (or the provider’s cash price if there is no negotiated rate). Click to read the Legal Update: Health Plans Must Provide Free Coronavirus COVID 19 Testing 03.31.20 Contact your Murray Health Benefits representative at 717.397.9600 with any questions.

Families First Coronavirus Response Act – HR Compliance

We’ve all heard about the Families First Coronavirus Response Act (FFCRA), but what does it entail? Highlights are below, but more information is available by clicking the links below. Highlights: Coronavirus relief legislation requires employers with fewer than 500 employees to provide 12 weeks of FMLA leave for child care reasons related to COVID-19. The new FMLA leave must be compensated after the first 10 days, at two-thirds of an employee’s wage, up to $200 per day. Employers must also provide 80 hours of paid sick time for specified reasons related to COVID-19. New Coronavirus Relief Law Requires Paid Employee Leave 3.27.20 More information can be found on the Department of Labor (DOL) FAQs page. Click here for the Department …

Families First Coronavirus Response Act Guidance and Forms

The Department of Labor (DOL) continues to update the questions and answers page regarding the Families First Coronavirus Response Act. New items of interest include: More detailed guidance on qualifications for small business exemption to FFCRA leave requirements Further details on definition of “individual” and “child” for purposes of employee taking emergency paid sick leave to care for another person If you haven’t posted the FFCRA notice, find it here. The PDF can be distributed by email or mail to employees who are working remotely. Questions can be addressed to your Murray Health Benefits representative or call us at 717.397.9600.

Managing Coronavirus Impacts on Employee Benefits

Murray and Contribution Health are partnering to help our clients navigate the everchanging circumstances brought on by the coronavirus pandemic. Below is a link to information regarding the Families First Coronavirus Response Act that is effective April 2, 2020, as well as a link to a summary of what the webinar covers. Families First Coronavirus Response Coronavirus Update Summary Any questions can be directed to your Murray Health Benefits Consultant or by contacting Matt Pfeiffenberger, Vice President, Health Benefits Solutions, via email or by calling 717.735.3069.

ACA Form 1095 Deadline Extended

According to BASIC HR Compliance & Technology, the IRS has extended the due date for certain 2018 information-reporting requirements for insurers, self-insuring employers, and certain other providers of minimum essential coverage under section 6055 of the Internal Revenue Code and for applicable large employers under section 6056 of the Code. Read more here.

IRS Reduces HSA Limit for Family Coverage for 2018

The IRS issued a new revenue procedure regarding health savings account (HSA) limits. The new tax laws had a provision in it which was not formally enacted until just recently. The new revenue procedure now puts the change into effect. Basically the ruling reduces the HSA family maximum contribution for 2018 from $6,900 to $6,850 retroactive to January 1, 2018. Employers with HSAs will need to check to see if employees elected the $6,900 maximum for 2018, and in effect cut that back to $6,850. The new $6,850 max is a combination of any employee and employer contributions into the employee’s HSA for 2018. You can read more about the change below. Questons can be directed to Matt Pfeiffenberger, Vice President, …

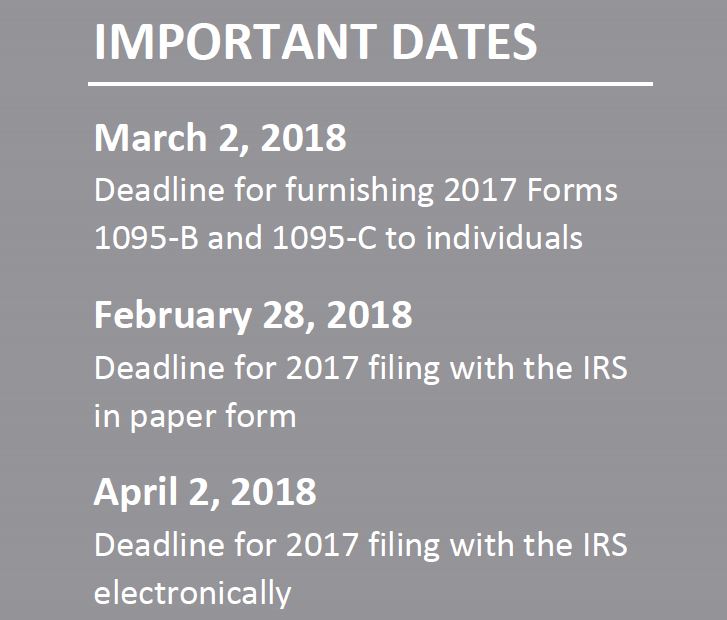

ACA Compliance – Furnishing Deadline Delayed for 2017 ACA Reporting

On December 22, 2017, the Internal Revenue Service (IRS) issued Notice 2018-06 to: Extend the due date for furnishing forms under Sections 6055 and 6056 for 2017 for 30 days, from January 31, 2018, to March 2, 2018; and Extend good-faith transition relief from penalties related to 2017 information reporting under Sections 6055 and 6056. Notice 2018-06 does not extend the due date for filing forms with the IRS for 2017. The due date for filing with the IRS under Sections 6055 and 6056 remains February 28, 2018 (April 2, 2018, if filing electronically). Section 6055 and 6056 Reporting Sections 6055 and 6056 were added to the Internal Revenue Code (Code) by the Affordable Care Act (ACA). Section 6055 applies …