By Slawomir Platta for Risk & Insurance Nearly every business is subject to rules and regulations from federal and/or state agencies, and the trucking industry is no exception. With the health and safety of so many people at risk, it’s vital that truck drivers, as well as other commercial vehicles, adhere to the laws put in place to protect the public. The primary organization that oversees the trucking industry is The Federal Motor Carrier Safety Administration, or FMCSA. It is a division of the U.S. Department of Transportation. The FMCSA enforces nationwide rules, including the size and weight restrictions of different commercial vehicles, the number of hours truckers can drive in a specific time period, and proper labeling and delivery …

What Manufacturers Need to Know About Loss Control, Pt. 3

Q&A with Ryan Overly, Risk Control Consultant with Murray, an AssuredPartners company By Jenn DeWalt, Business Development Specialist, Murray This is the third part of a series on safety considerations for manufacturing companies: The first part of the series covered specific loss control considerations manufacturing companies need to consider regarding workers’ compensation and keeping their employees safe. The second part of the series covered information on the top causes of loss in the manufacturing industry. Almost $1.2 billion is paid out every week in our country for workers’ compensation claims. Manufacturers in particular may be experiencing what often seem like small incidents, but those small claims are certainly adding up. Ryland Overly, GSP, Risk Control Consultant from Murray’s Risk Management …

What Manufacturers Need to Know About Loss Control, Pt. 2

Q&A with Ryan Overly, Risk Control Consultant with Murray, an AssuredPartners company By Jenn DeWalt, Business Development Specialist, Murray This is the second part of a series on safety considerations for manufacturing companies: The first part of the series covered specific loss control considerations manufacturing companies need to consider regarding workers’ compensation and keeping their employees safe. Almost $1.2 billion is paid out every week in our country for workers’ compensation claims. Manufacturers in particular may be experiencing what often seem like small incidents, but those small claims are certainly adding up. Ryland Overly, GSP, Risk Control Consultant from Murray’s Risk Management team, offers information that can help those businesses in the manufacturing industry develop a better safety culture. Q: …

What Manufacturers Need to Know About Loss Control

Q&A with Ryan Overly, Risk Control Consultant with Murray, an AssuredPartners company By Jenn DeWalt, Business Development Specialist, Murray This is the first part of a series on safety considerations for manufacturing companies: Almost $1.2 billion is paid out every week in our country for workers’ compensation claims. Manufacturers in particular may be experiencing what often seem like small incidents, but those small claims are certainly adding up. Ryland Overly, GSP, Risk Control Consultant from Murray’s Risk Management team, offers information that can help those businesses in the manufacturing industry develop a better safety culture. Q: Are there specific loss control considerations for manufacturing companies regarding Workers’ Compensation? A: Yes! While manufacturing companies are the same in some basic …

What Determines the Cost of a Surety Bond?

By Sarah Licata for AssuredPartners The price of surety bonds can vary greatly, and many people are unclear of why this is. When determining premium, surety companies are looking to determine the amount of risk there is with an applicant by considering at a variety of indicating factors. Below are some key factors that may be considered when determining bond premium. Type of Surety Bond There are many different types of surety bonds and the type of bond required can vary in price. This is due to the fact that each surety bond guarantees a unique risk, and the level of risk the surety company is taking on is factored into the premium. In short, the higher the level of …

Captives: Claims Handling

By Denise Gillin for AssuredPartners For both property & casualty (P&C) and Employee Benefits (EB) captives, the strong focus on claim management is one of the most important membership benefits. Current clients sometimes say it’s how their claims are handled that tests the insurance coverage decisions they made. We agree. Having the right program is indeed the basis of successfully navigating an issue, and it’s important to address any concerns from “day one – minute one”. For the AssuredPartners P&C and EB Captives Vertical Service Teams, this entails looking at loss control and claims as a cycle of continuous improvement and being dedicated to providing services that include education, advocacy, availability, risk management service planning, and proactive claim management. Read …

Top Tips for Winter Safety

By Gina Ekstam for AssuredPartners Winter weather may have already appeared in your area, but if not, Jack Frost will likely pay a visit soon. Freezing temperatures, heavy snow, and ice are tough on nearly everything – creating a range of hazards – so be mindful and ready to react to weather changes to help protect your agribusiness operation. Worker Safety Even if you’re not in an area that gets frigid, the cold weather can still be dangerous. Those who work outdoors face the dangers of lowered body temperature, hypothermia, and frostbite. The following precautions can keep your workers safe: Dress for the weather to protect the body’s core. Multiple layers will help to keep body temperatures from dropping. The …

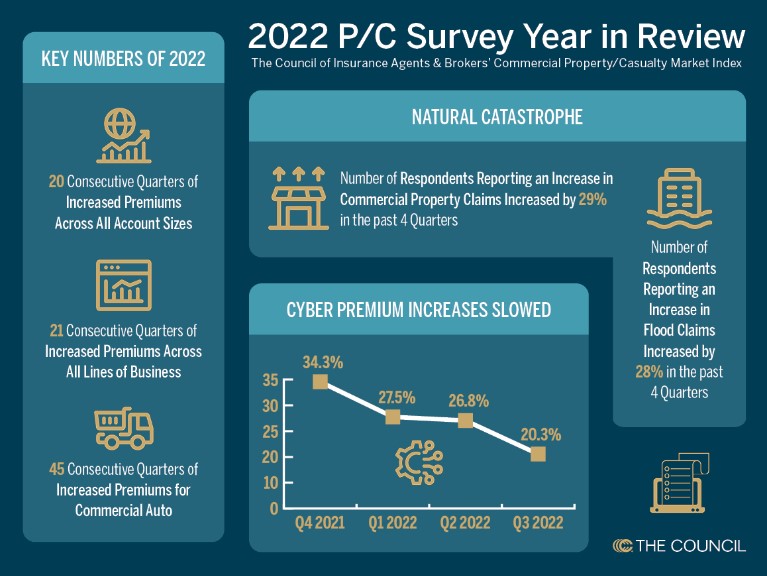

Commercial P/C Market Index Year in Review: 2022

By Zach West for Leader’s Edge Premium pricing increases slowed; most lines saw some relief. Premium pricing stabilized slightly in 2022, with slower increases for most lines compared to 2020 and 2021. The majority of lines recorded lower average increases at the end of 2022 compared to the beginning of the year. Workers compensation was the only line that saw a decrease in 2022, with premiums, ending the year at -0.7%. Despite the slowing of increases, respondents were clear that market conditions were still challenging in 2022, pointing to tight underwriting, increased scrutiny, and decreased carrier appetite. Read full article here>>>

We now accept credit card payments!

For your ease and convenience, Murray now offers credit card payments for your policy invoice! Please click on the link below to make your payment. Contact us at 717.397.9600 with any questions. Thank you!

Managing the Numbers: A Look Inside TRIR, DART, and Experience Modification Factors

By Tara Crisp for AssuredPartners Oil and gas contractors often secure and maintain work based on their Total Recordable Incident Rate, TRIR, and/or Experience Modification Factor. If either of those numbers goes above a 1.0, then a contractor may not be allowed to continue to perform work for an operator. Understanding how to manage your TRIR, DART and experience modification factor can be a useful tool in maintaining your current and future business operations. The TRIR is intended to assist employers to understand how they, the safety team, and the company is performing on at least one dimension of safety. Because incidents capture and cover such a large part of the safety spectrum, it is one of the most common …