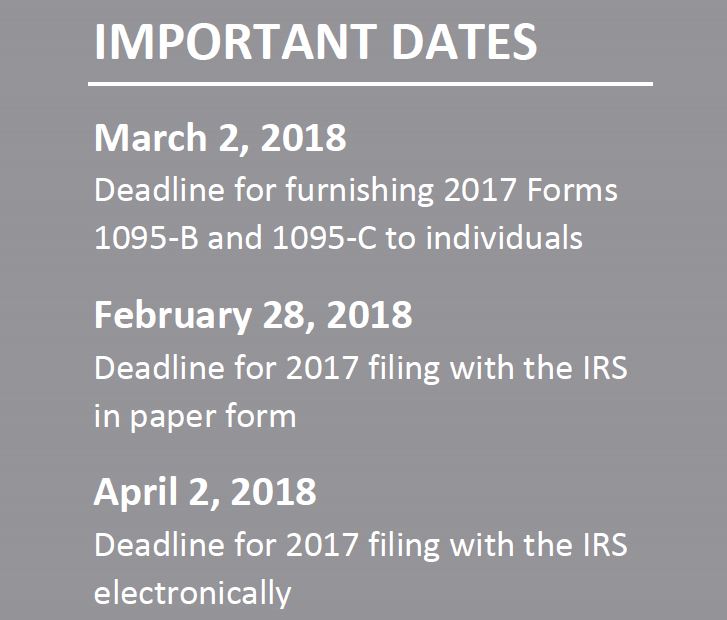

On December 22, 2017, the Internal Revenue Service (IRS) issued Notice 2018-06 to: Extend the due date for furnishing forms under Sections 6055 and 6056 for 2017 for 30 days, from January 31, 2018, to March 2, 2018; and Extend good-faith transition relief from penalties related to 2017 information reporting under Sections 6055 and 6056. Notice 2018-06 does not extend the due date for filing forms with the IRS for 2017. The due date for filing with the IRS under Sections 6055 and 6056 remains February 28, 2018 (April 2, 2018, if filing electronically). Section 6055 and 6056 Reporting Sections 6055 and 6056 were added to the Internal Revenue Code (Code) by the Affordable Care Act (ACA). Section 6055 applies …

IRS Issues Pay Or Play Enforcement Guidance

On Nov. 2, 2017, the Internal Revenue Service (IRS) updated its Questions and Answers (Q&As) on the employer shared responsibility rules under the Affordable Care Act (ACA) to include information on enforcement. Specifically, these Q&As include guidance on: How an employer will know that it owes an employer shared responsibility penalty; Appealing a penalty assessment; and Procedures for paying any penalties owed. The IRS also maintains a website on understanding Letter 226-J, as well as a sample letter, which will be used to inform employers of their potential penalty liability. Action Steps – No penalties have been assessed under the employer shared responsibility rules at this time. However, employers subject to these rules are still responsible for compliance. These Q&As indicate …

IRS Confirms ACA Mandate Penalties Still Effective

The Internal Revenue Service (IRS) Office of Chief Counsel has recently issued several information letters regarding the Affordable Care Act’s (ACA) individual and employer mandate penalties. These letters clarify that: Employer shared responsibility penalties continue to apply for applicable large employers (ALEs) that fail to offer acceptable health coverage to their full-time employees (and dependents); and Individual mandate penalties continue to apply for individuals that do not obtain acceptable health coverage (if they do not qualify for an exemption). These letters were issued in response to confusion over President Donald Trump’s executive order directing federal agencies to provide relief from the burdens of the ACA. Action Steps These information letters clarify that the ACA’s individual and employer mandate penalties still …

IRS Reaffirms ACA’s Employer Mandate

By David J. Ledermann, Esq., Barley Snyder While the long-term future of the Affordable Care Act may be in doubt, the law’s application to employers remains largely unaffected by recent political developments. Information letters recently released by the IRS Office of Chief Counsel, responding to inquiries about the status of the ACA’s employer shared responsibility requirements (the “employer mandate”), emphasize that these requirements remain effective. Therefore, an “applicable large employer” (an organization, or group of related organizations, that averaged at least 50 or more full-time equivalent employees in the prior year) could face penalties for failing to offer adequate health coverage to full-time employees and their non-spouse dependents. The IRS information letters indicate that no waivers under the employer mandate …

Senate Votes to Move on to ACA Repeal and Replace Debate

This summary is provided by the Health Benefits Solutions team at Murray. Source: Joel Kopperud, Vice-President, Government Affairs Council of Insurance Agents and Brokers (CIAB) On Tuesday afternoon, July 25, the Senate voted 51-50 to open debate on ACA repeal-and-replace legislation! Vice President Pence cast the tie-breaking vote with Senators Susan Collins (R-ME) and Lisa Murkowski (R-AK) opposing the measure. This is a procedural vote that allows the Senate to now vote on a series of amendments which will ultimately determine what the replacement legislation will look like. There will most likely be a vote on 3 amendments: Senator Rand Paul’s (R-KY) amendment to fully repeal the ACA Senator Ted Cruz’s (R-TX) amendment to allow for “skinny” insurance plans Senators …

What Happens if the ACA Employer Mandate is Repealed?

The Affordable Care Act (ACA) requires applicable large employers (ALEs) to offer affordable, minimum value health coverage to their full-time employees in order to avoid possible penalties. Because this employer mandate has been criticized as burdensome for employers and an impediment to business growth, its repeal has been a central part of Republican plans to repeal and replace the ACA. If the employer mandate is repealed, many ALEs will likely want to modify their plan designs to go back to pre-ACA eligibility rules (for example, requiring employees to have a 40-hour-per-week work schedule to be eligible for benefits). Employers may also consider increasing the amount that employees are required to contribute for group health plan coverage. Current Status of the …

Healthcare Reform and House Amended AHCA – Right Back Where We Started

You have no doubt seen many articles, news releases or media reports on the House passage on May 4th on the amended American Health Care Act or AHCA (H.R. 1628). The vote, 217 to 213, was on strict party lines with 20 Republicans joining 193 Democrats in voting against the measure. In Pennsylvania, 13 Republicans voted for the Act, including Congressmen Barletta, Marino, Smucker and Perry while Congressmen Dent, Costello, Fitzpatrick and Meehan were no votes. The split among Pennsylvania’s Republicans is indicative of the inner turmoil within the Republican Party when it comes to any attempt to repeal Obamacare. We would like to provide you with an in-depth summary of the newly amended AHCA but what’s the point? We …

How Repealing the ACA Could Affect Employer-Sponsored Health Plans

Overview Since the Affordable Care Act (ACA) was enacted in 2010, employers and health insurance issuers have had to make numerous changes to employer-sponsored group health plans offered to employees. If the ACA is repealed, many plan terms may no longer be required. These changes may be beneficial for employers, but could be confusing or, in some cases, unwelcome for employees. The ultimate impact of repealing the ACA will depend on the specific details of the repeal, and any replacement, that is enacted. While steps have been made toward repeal, it is unclear what impact those steps may have or what an ACA replacement will look like. Action Steps The initial steps, including an executive order issued by President Donald …