The IRS issued a new revenue procedure regarding health savings account (HSA) limits. The new tax laws had a provision in it which was not formally enacted until just recently. The new revenue procedure now puts the change into effect. Basically the ruling reduces the HSA family maximum contribution for 2018 from $6,900 to $6,850 retroactive to January 1, 2018. Employers with HSAs will need to check to see if employees elected the $6,900 maximum for 2018, and in effect cut that back to $6,850. The new $6,850 max is a combination of any employee and employer contributions into the employee’s HSA for 2018. You can read more about the change below. Questons can be directed to Matt Pfeiffenberger, Vice President, …

ACA Compliance – Furnishing Deadline Delayed for 2017 ACA Reporting

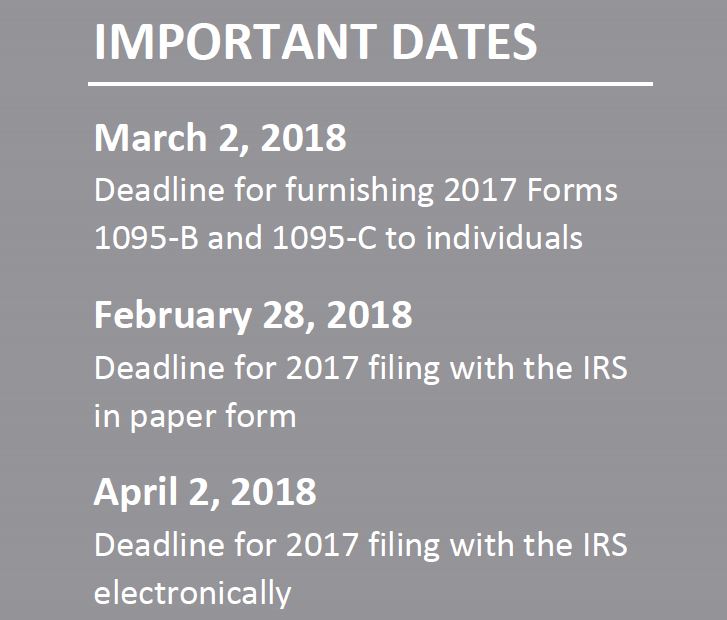

On December 22, 2017, the Internal Revenue Service (IRS) issued Notice 2018-06 to: Extend the due date for furnishing forms under Sections 6055 and 6056 for 2017 for 30 days, from January 31, 2018, to March 2, 2018; and Extend good-faith transition relief from penalties related to 2017 information reporting under Sections 6055 and 6056. Notice 2018-06 does not extend the due date for filing forms with the IRS for 2017. The due date for filing with the IRS under Sections 6055 and 6056 remains February 28, 2018 (April 2, 2018, if filing electronically). Section 6055 and 6056 Reporting Sections 6055 and 6056 were added to the Internal Revenue Code (Code) by the Affordable Care Act (ACA). Section 6055 applies …